War Tax Resistance Sees Surge Amid Gaza Conflict and Growing Political Concerns

Jerry Windley-Daoust interviews Catholic Worker Lincoln Rice about his role in war tax resistance

War Tax Resistance Sees Surge Amid Gaza Conflict and Growing Political Concerns

By Jerry Windley-Daoust

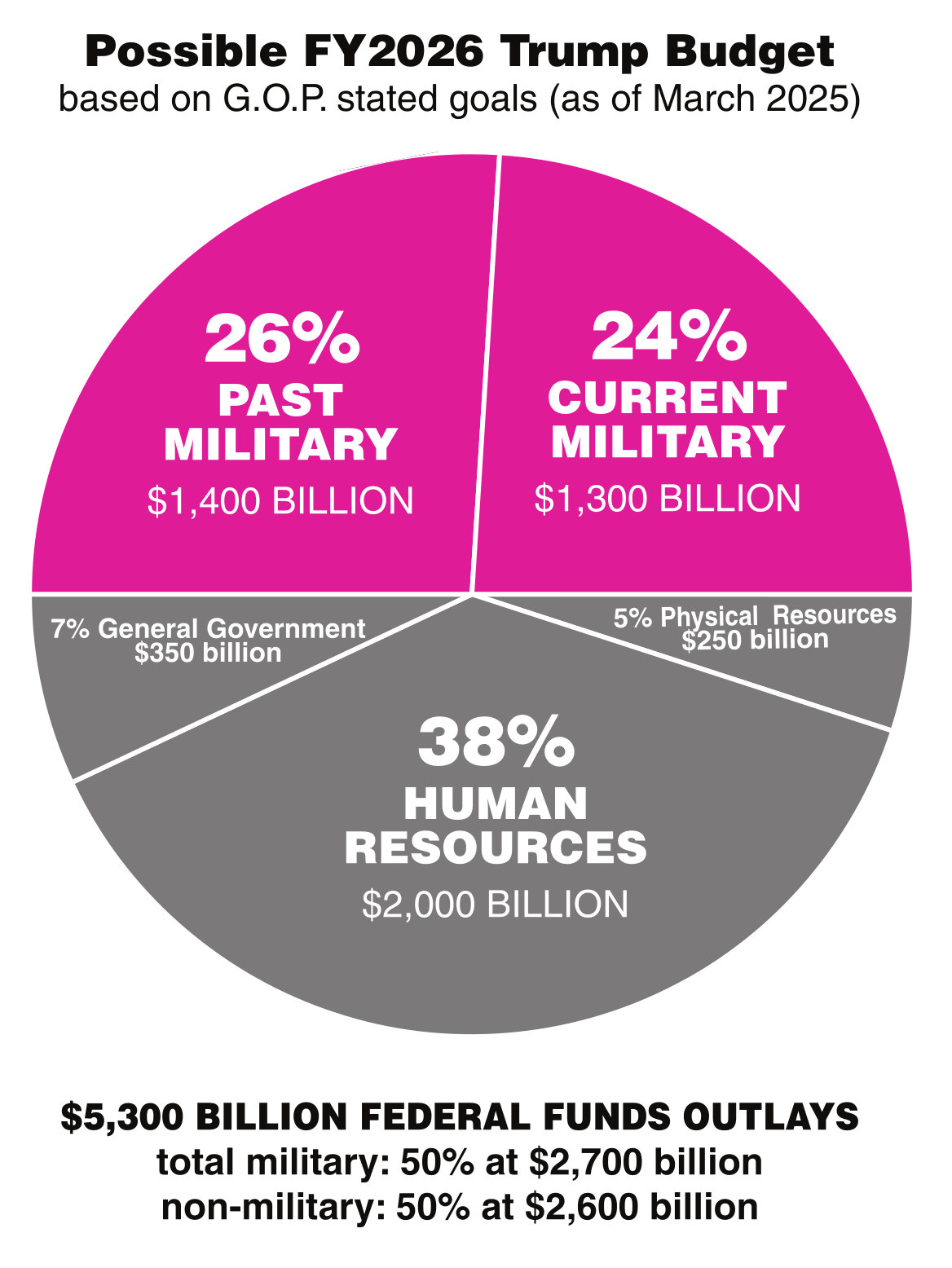

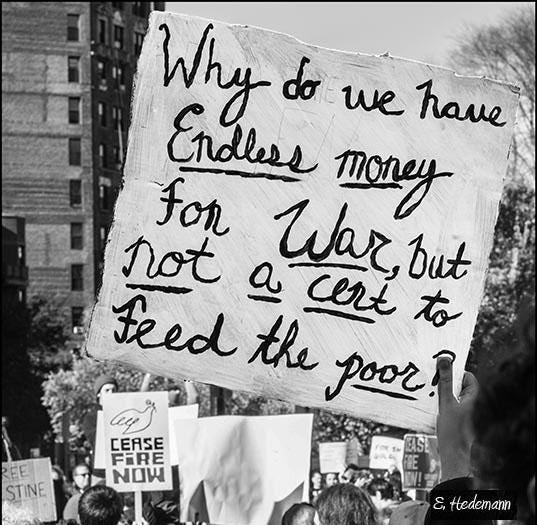

Interest in war tax resistance has surged dramatically over the past year or so, driven in large part by concern over the U.S.-funded war in Gaza among younger and more diverse Americans, according to Lincoln Rice, a member of the Casa Maria Catholic Worker community in Milwaukee.

Rice, who also serves as a part-time staffer for the National War Tax Resistance Coordinating Committee (NWTRCC), said the Gaza invasion served as a flashpoint for a new wave of interest in resisting the use of federal tax dollars to fund military action.

“Before the invasion of Gaza, most of the folks we heard from were older and white,” said Rice. The first surge of interest in war tax resistance came in late 2023 and early 2024 from younger, more racially diverse people searching online for ways to avoid paying for U.S. weapons being used against Gazans.

“When they could clearly see online and in their Instagram feeds the devastation happening in Gaza with U.S. weapons, I think it made them find us,” Rice said.

The surge of interest is reflected in NWTRCC’s Instagram following. Prior to October 7, 2023, the organization had about 600 followers; now, that number stands at more than 25,000.

In response to growing demand, Rice and colleague Chrissy Kirchhofer from the St. Louis Catholic Worker have been conducting one to two workshops weekly. While the NWTRCC is not exclusively a Catholic Worker project, Catholic Workers have historically played significant roles in the movement. Dorothy Day advocated it as early as 1943, and Karl Mayer helped spread the practice in the 1960s and 1970s. Currently, both part-time staff members of NWTRCC happen to be Catholic Workers, though the organization includes people from various backgrounds, with Quakers and Mennonites being particularly well-represented.

While outrage over U.S. weapons funding for the war in Gaza sparked the initial increase, more recent interest—particularly from white, middle-class Americans—has focused on domestic political threats, such as fears over authoritarianism or proposals to eliminate the Department of Education.

When newcomers attend workshops, Rice says the biggest hurdle for many participants is fear.

“People worry about going to jail,” he said. “But the reality is, if you file your tax forms correctly and simply don’t pay, the risk of prosecution is almost zero.”

Instead, he said, the consequences are more likely to be financial—wage garnishment or levies—and even those are rare. While it’s technically illegal for employers to fire someone for having tax debt, Rice acknowledged that some fear retaliation from employers who disagree with their stance. However, he added, “I’ve not been aware of people losing jobs or being unable to find work because of war tax resistance.”

In the current political climate, some activists worry that a second Trump administration could weaponize the IRS against political dissidents. But Rice says recent cuts to IRS staffing make widespread targeting unlikely, at least in the near term.

For those considering war tax resistance this tax season, Rice said it's not too late. Even if you have already filed your taxes or are due for a refund, you can update your W-4 with your employer at any time to reduce or eliminate federal withholding for future tax seasons.

For more information or to find a workshop, visit the National War Tax Resisters website or follow NWTRCC on Instagram. For instructions on how to modify your W-4, see this page on the NWTRCC website. And for a more in-depth perspective on war tax resistance, see Rice’s essay for The Catholic Worker: War Tax Resistance: A Catholic Worker Tradition.

About us. Roundtable is a publication of catholicworker.org that covers the Catholic Worker Movement.

Roundtable is independent of the New York Catholic Worker or The Catholic Worker newspaper. This week’s Roundtable was produced by Renée Roden and Jerry Windley-Daoust. Send inquiries to roundtable@catholicworker.org.

Subscription management. Add CW Reads, our long-read edition, by managing your subscription here. Need to unsubscribe? Use the link at the bottom of this email. Need to cancel your paid subscription? Find out how here. Gift subscriptions can be purchased here.

Paid subscriptions. Paid subscriptions are entirely optional; free subscribers receive all the benefits that paid subscribers receive. Paid subscriptions fund our work and cover operating expenses. If you would like to stop seeing Substack’s prompt to upgrade to a paid subscription, please email roundtable@catholicworker.org.